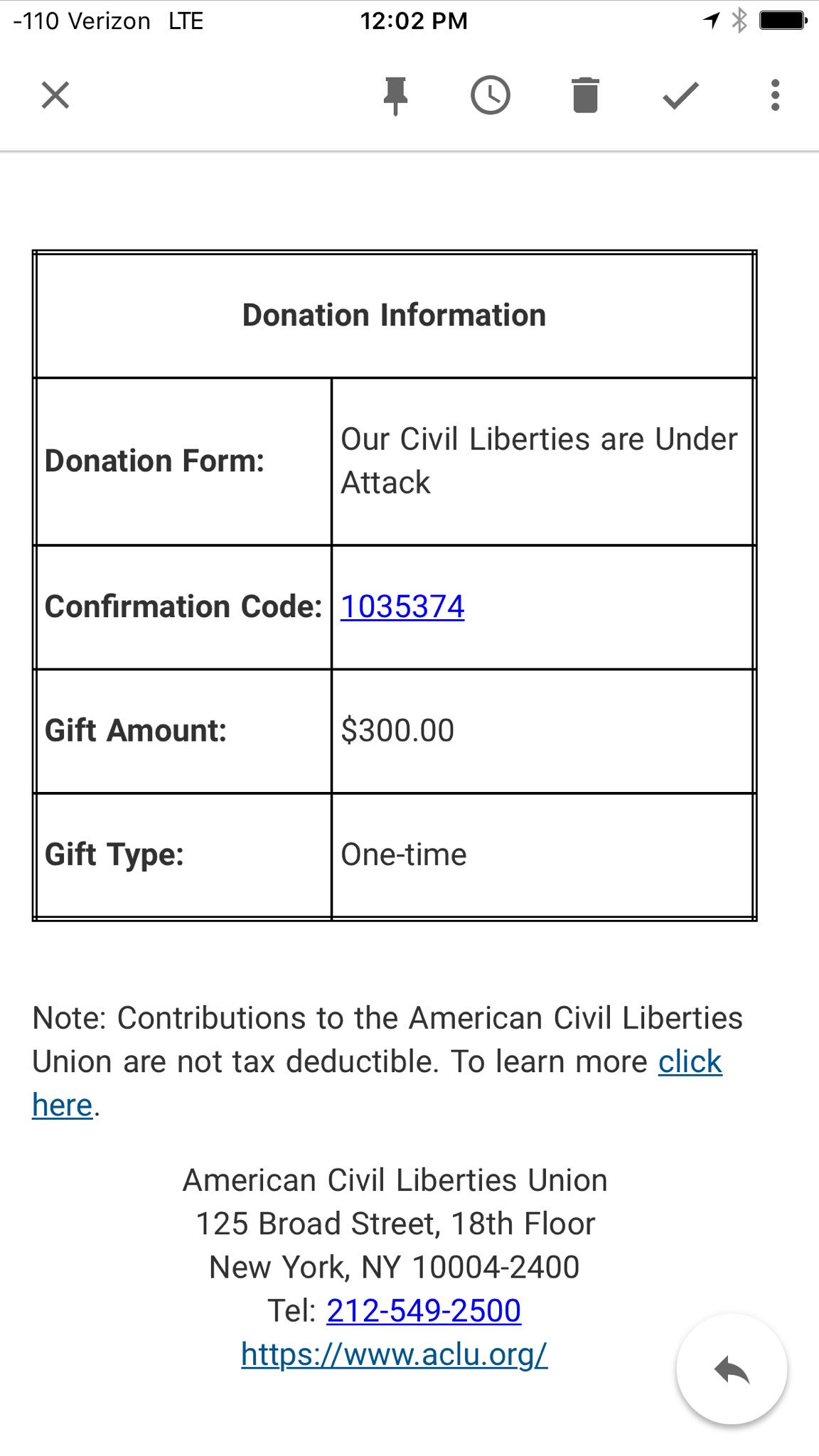

aclu not tax deductible

The ACLU provides our corporate supporters with unique opportunities to demonstrate your companys values and commitment to advancing civil rights and civil liberties for all. The tax ID of the American Civil Liberties Union.

The A C L U Impeccable Judgments Or Tainted Policies The New York Times

The ACLU Foundation is the arm of the ACLU that conducts our litigation and education efforts.

. Gifts to the ACLU Foundation of Massachusetts are. ACLU Membership not tax-deductible Join the ACLU of Texas a 501c4 non-profit or renew your membership. It is the membership organization and you have to be a member to get your trusty ACLU card.

The ACLU of Missouri Foundation supports litigation. Contributions to the aclu are not tax. While not tax deductible they advance our extensive litigation communications and public education programs.

Making a gift to the ACLU via a wire transfer allows you to have an immediate impact. Support the ACLU Foundation of Texas. These organizations are not considered to.

ACLU - tax deductible. They also enable us to advocate and lobby in legislatures at the federal. The aclu locks in in administrative campaigning.

Contributions to the American Civil Liberties Union are not tax deductible. Contributions to the aclu are not tax deductible. Why are contributions to the ACLU not tax deductible for charitable purposes.

Membership dues and other gifts to the american civil liberties union are not tax deductible. The ACLU is a 501c 4 nonprofit corporation but gifts to it are not tax-deductible. Hydrocortisone November 29 2003 916am 1.

Donate to the ACLU today to help protect the rights and liberties of people across the country. Make your tax-deductible gift today and help us fight alongside people whose rights are in severe jeopardy. Gifts to the ACLU Foundation are tax-deductible to the donor to the extent permissible by law.

When you make a contribution you become a card-carrying member of the. Gifts to the ACLU-NJ Foundation are fully tax-deductible to the donor you can make a tax-deductible donation here. The aclu foundation is a 501c3 nonprofit which means donations made to it are tax deductible.

The aclu foundation is a 501c3 nonprofit which means donations made to it are tax deductible. Answer 1 of 6. The aclus dual structure is not unusual.

American civil liberties union inc. Membership dues and other gifts to the american civil liberties union are not tax deductible. ACLU Membership not tax-deductible Join the ACLU of Northern California a 501c4 non-profit or renew your membership.

For more details please email us at email protected or by phone at 2122847381. The ACLU of Missouri Foundation is a non-profit 501 organization and donations made to it are fully tax-deductible. As other answers have noted the ACLU proper is a tax-exempt organization per section 501c4 of the Internal Revenue Code.

To make a bequest that qualifies for a federal estate tax charitable deduction you may direct your gift to the ACLU Foundation as follows. Aclu Not Tax Deductible. When you make a contribution you become a card-carrying.

American civil liberties union inc. Aclu Not Tax Deductible.

How The Aclu Works Howstuffworks

Aclu Of Illinois Thomas Richie

Aclu Steps Into The Fight To Stop Closure Of Homeless Meals Kitchen In Orange

Join Donate Or Both Aclu Of Minnesota

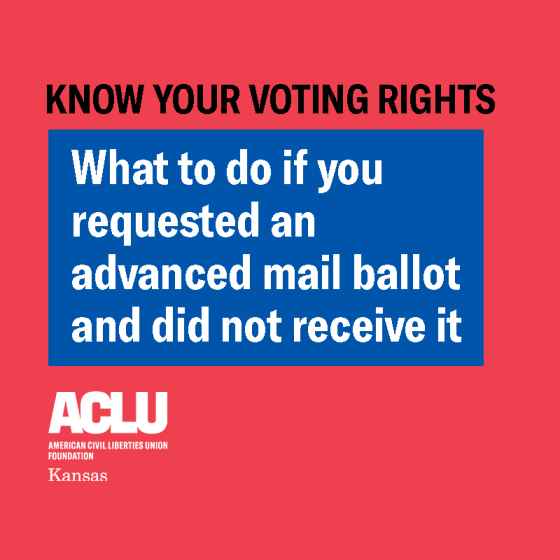

Know Your Rights Aclu Of Kansas

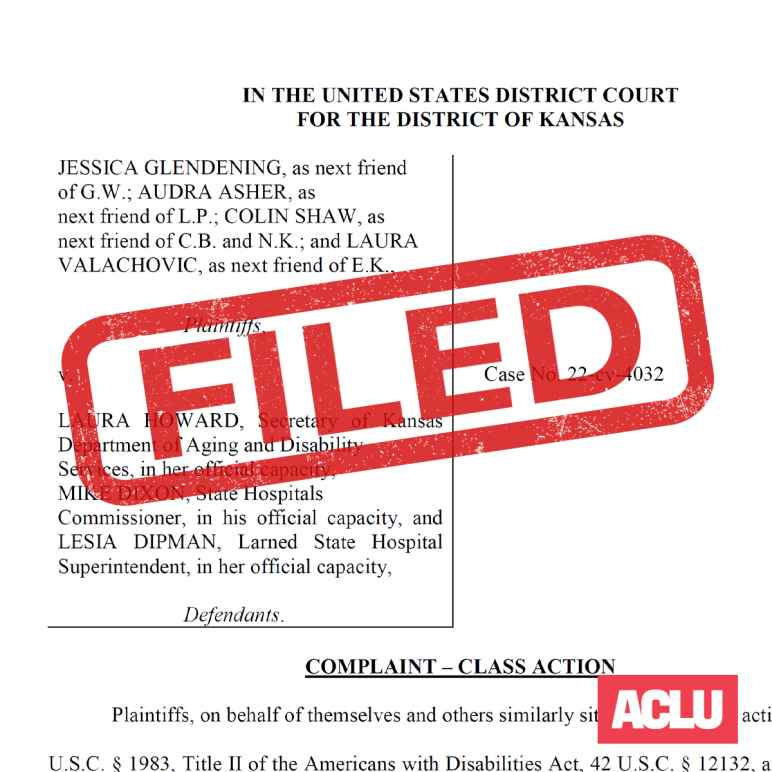

Glendening Et Al V Howard Et Al Kdads Larned State Hospital Aclu Of Kansas

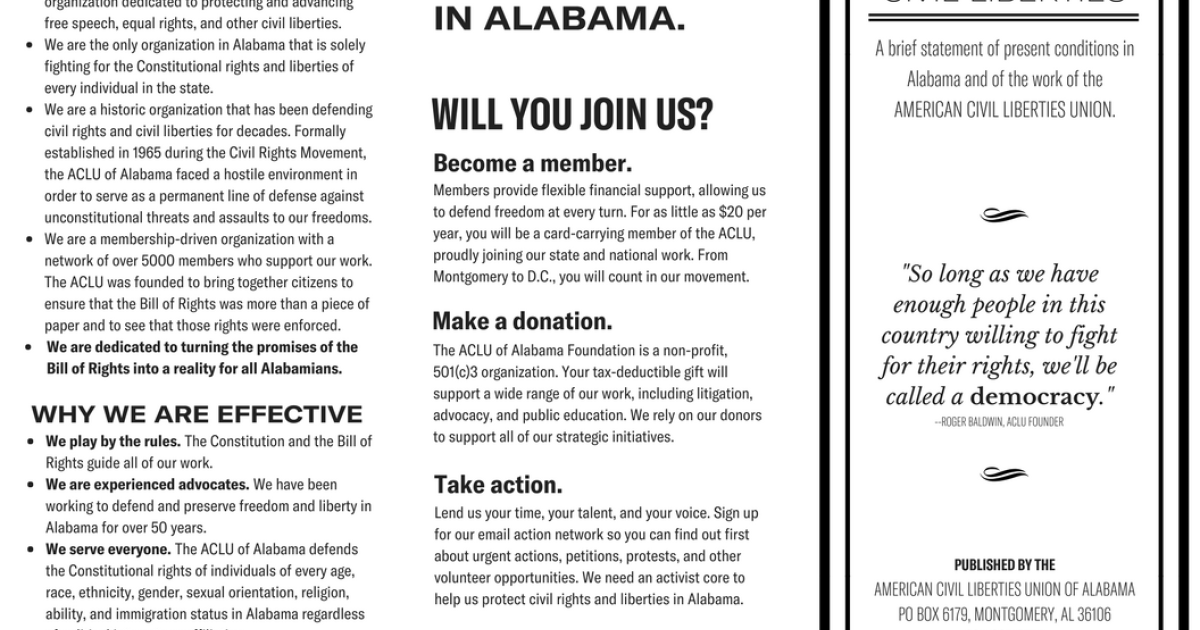

Aclu Of Alabama Quick Facts Aclu Of Alabama

Ford County Clerk Does Not Oppose The Aclu Of Kansas Motion To Dismiss Lawsuit Plaintiffs Score Two New Voting Stations In Dodge City Aclu Of Kansas

What S The Difference Aclu Of Washington

Utah Pride Center And Aclu Utah Response Urging Principals To Ignore Harmful Guidance That Will Hurt Trans Students Utah Pride Center

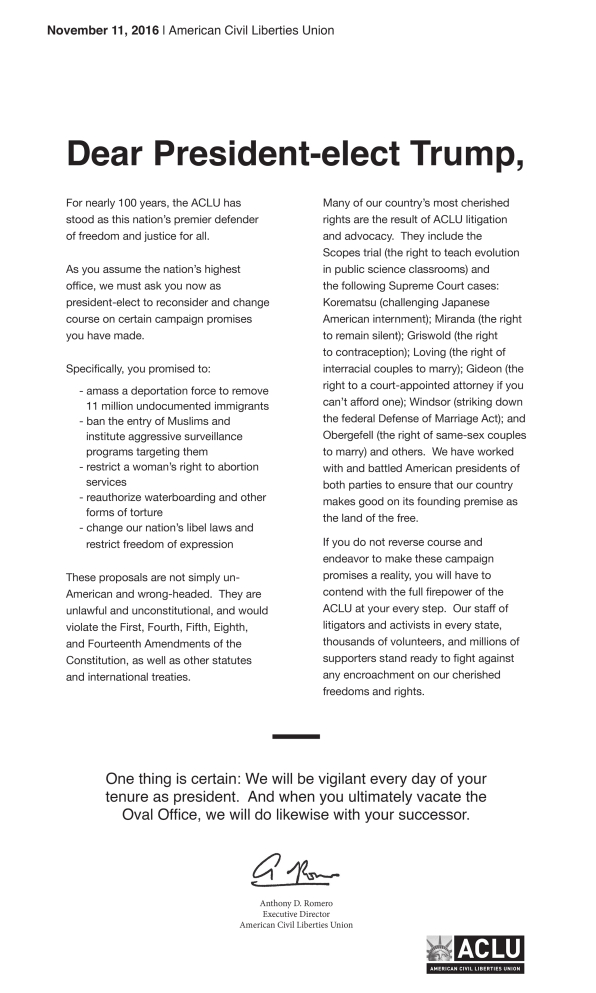

How The Aclu Is Leading The Resistance

What S The Difference Aclu Of Washington