sales tax in fulton county ga 2019

If you need reasonable accommodations due to a disability including communications in an alternative format please contact the Disability Compliance Liaison at 404612-9166. 2020 rates included for use while preparing your income tax deduction.

Reimagining Revenue How Georgia S Tax Code Contributes To Racial And Economic Inequality Georgia Budget And Policy Institute

Mayors Meeting.

. GA 30303 404-612-4000 customerservicefultoncountygagov. What is the sales tax rate in Fulton County. Fultons rate inside Atlanta is 3.

I didnt see any data on the SF sales tax revenue. Except when the first Tuesday of the month falls on a legal holiday in which case the sale is held the next. Fulton County Sheriffs Tax Sales are held on the first Tuesday of each month between the hours of 10 am.

The Fulton County Sheriffs Office month of November 2019 tax sales. This presentation outlines an update to Fulton Countys Transit Master Plan. The 85 sales tax rate in Atlanta consists of 4 Georgia state sales tax 26 Fulton County sales tax 15 Atlanta tax and 04 Special taxThe sales tax jurisdiction name is Atlanta Tsplost Tl which may refer to a local government divisionYou can print a 85 sales tax table hereFor tax rates in other cities see Georgia sales taxes by city and county.

060 Fulton Not Atlanta 775 ML E Tf 060A Fulton In Atlanta 89 ML E O mTa 061 Gilmer 7 L E S 062 Glascock 8 L E S T 063 Glynn 7 L E. Water and Sewer Expenditures July YTD 2019. The December 2020 total local sales tax rate was also 7750.

3202019 115501 AM. Georgia has a 4 sales tax and Fulton County collects an additional 26 so the minimum sales tax rate in Fulton County is 66 not including any city or special district taxes. The Fulton County Georgia sales tax is 775 consisting of 400 Georgia state sales tax and 375 Fulton County local sales taxesThe local sales tax consists of a 300 county sales tax and a 075 special district sales tax used to fund transportation districts local attractions etc.

This rate includes any state county city and local sales taxes. 060 Fulton Not Atlanta 775 ML E Tf 060A Fulton In Atlanta 89 ML E O mTa 061 Gilmer 7 L E S 062 Glascock 8 L E. The Georgia state sales tax rate is currently.

This is the total of state and county sales tax rates. The Fulton County sales tax rate is. A TAX SALE IS THE SALE OF A TAX LIEN BY A GOVERNMENTAL ENTITY FOR UNPAID PROPERTY TAXES BY THE PROPERTYS OWNER.

Actual Salary and Benefits. The 2018 United States Supreme Court decision in South Dakota v. FULTON COUNTY GEORGIA July 2019 FINANCIAL RESULTS Unaudited Cash Basis.

GEORGIA SALES AND USE TAX RATE CHART Effective April 1 2019 updated 32019. Interactive Tax Map Unlimited Use. The current total local sales tax rate in Fulton County GA is 7750.

The Fulton County Sales Tax is collected by the merchant on all qualifying sales made within. The Board of Commissioners and County Manager have categorized County efforts into. Fulton County Tax Sale-Bidder Registration Bidder Information YOU MUST REGISTER EVERY MONTH.

On Thursday November 21 2019. This table shows the total sales tax rates for all cities and towns in Fulton County including all local taxes. Ad Lookup Sales Tax Rates For Free.

GEORGIA SALES AND USE TAX RATE CHART Effective January 1 2019 Code 000 The state sales and use tax rate is 4 and is included in the jurisdiction rates below. The latest sales tax rate for Atlanta GA. For TDDTTY or Georgia Relay Access.

Due to renovations at the Fulton County Courthouse. The proposed short-term plan update includes 16 B in rapid transit projects across Fulton County based on the passage of HB 930 which allows for a 02-cent sales tax over 30 years 100 M in State funding allocated to GA 400 and an assumed 200 M in Federal. The minimum combined 2022 sales tax rate for Fulton County Georgia is.

This website will be temporarily unavailable for a short time between 7 am.

Reimagining Revenue How Georgia S Tax Code Contributes To Racial And Economic Inequality Georgia Budget And Policy Institute

Frequently Asked Questions Faq Atlanta Ga

![]()

Georgia New Car Sales Tax Calculator

Reimagining Revenue How Georgia S Tax Code Contributes To Racial And Economic Inequality Georgia Budget And Policy Institute

Reimagining Revenue How Georgia S Tax Code Contributes To Racial And Economic Inequality Georgia Budget And Policy Institute

Sales Tax Collections Plummet At Least 15 In Metro Atlanta In June New Gsu Research Tool Saportareport

How To Register For A Sales Tax Permit In Georgia Taxvalet

Talmo Ga Land For Sale Real Estate Realtor Com

Sales Tax Collections Plummet At Least 15 In Metro Atlanta In June New Gsu Research Tool Saportareport

Atlanta Georgia S Sales Tax Rate Is 8 5

Reimagining Revenue How Georgia S Tax Code Contributes To Racial And Economic Inequality Georgia Budget And Policy Institute

Baldwin County Georgia Detailed Profile Houses Real Estate Cost Of Living Wages Work Agriculture Ancestries And More

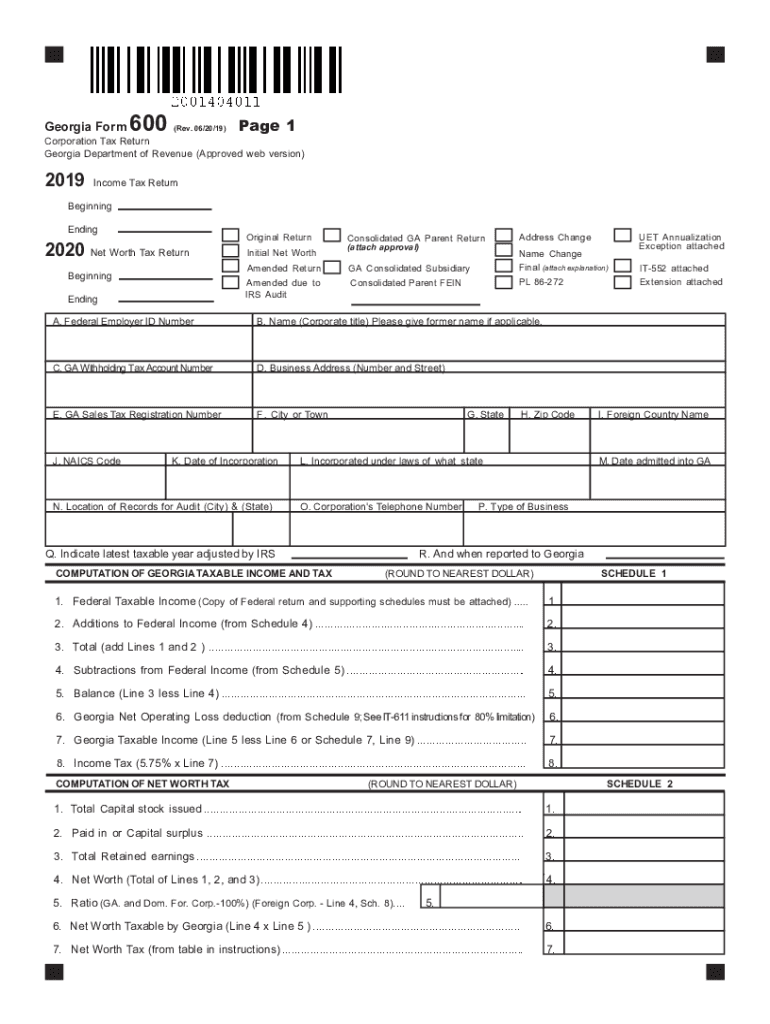

Ga Dor 600 2019 2022 Fill Out Tax Template Online Us Legal Forms

Reimagining Revenue How Georgia S Tax Code Contributes To Racial And Economic Inequality Georgia Budget And Policy Institute